Form 941 Retention Credit Worksheet 1

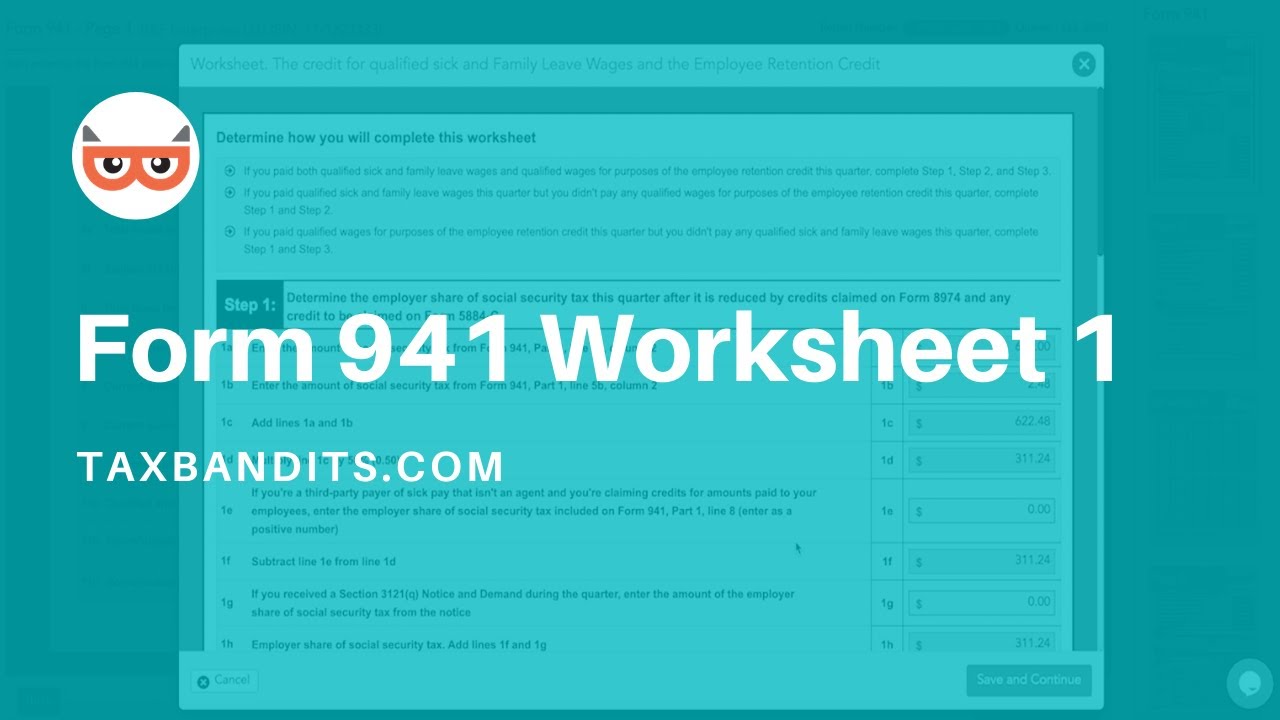

Worksheet 1 is available on page 20 of the instructions for Form 941. If you have questions throughout your e-filing process feel free to reach out to our support team.

941 Worksheet 1 Credit For Qualified Sick And Family Leave Wages And The Employee Retention Credit Das

Total deposits deferrals and refundable credits.

Form 941 Retention Credit Worksheet 1. 1 The Borrower must be self-employed ie have an ownership interest of 25 or. On line 11c enter the nonrefundable portion of the Employee Retention Credit ERC from Worksheet 1 Step 3 line 3h if applicable. With the 202023 update weve added informational diagnostics for Worksheet 1.

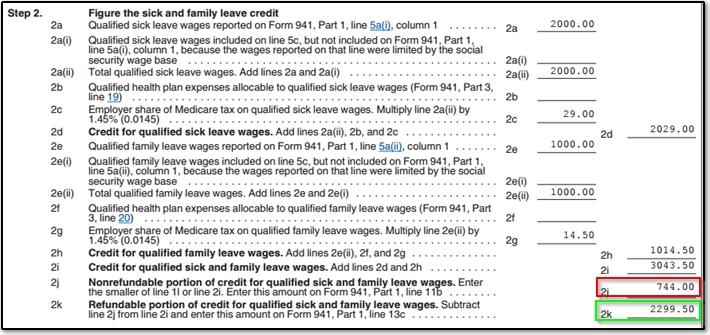

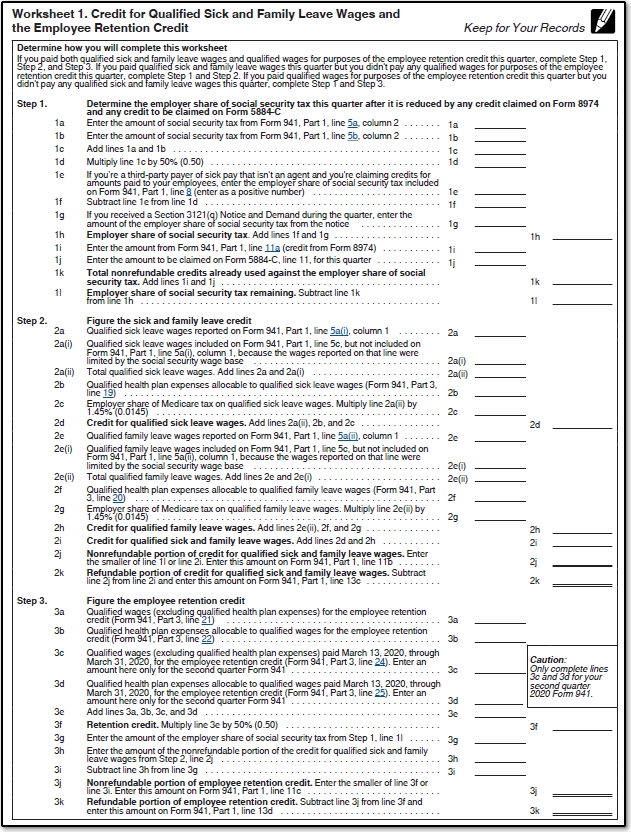

Figure the sick and family leave credit Step 3. Before you can begin filling out Form 941 you must collect some information. 2020 Q4 Form 941 2021 Q1 Form 941.

Worksheet 1 in the Instructions for Form 941 can help you calculate your tax refunds and deferments for the qualified Credit for Sick and Family Leave and the Employee Retention Credit. Figure the employee retention credit WORKSHEET 1. Employers who file Form 941 Employers QUARTERLY Federal Tax Return must file the revised form with COVID-19 changes from Quarter 2 of 2020Now IRS has revised the Form 941 for Q2 2021 which the filers must use for the second quarter of 2021.

How to Log in to Beyond. This line was used to report the total amount of tax deposits made in the quarter total deferred social security taxes refundable portion of qualified sick and family leave wages and employee retention credit Total deposits and refundable credits. Complete signed federal individual and corporation Form 1120 income tax returns including Form 1125-E and W-2s as applicable for the most recent two years.

For more information about the credit for qualified sick and family leave wages go to IRSgovPLC. Enter this amount on Form 941 Part 1 line 11c 3i Refundable portion of employee retention credit. The next step is to figure out if you have a balance due or an overpayment.

The ARP adds new. With the second quarter deadline for Form 941 approaching on July 31 2020 now is a great time to begin e-filing your form. The ERC is 50 of the qualified wages you paid to your employees in the quarter.

Enter the same amount on Worksheet 1 Step 3 line 3b. Line 22 - Qualified health plan expenses allocable to wages reported on line 21. Enter the qualified wages for the Employee Retention Credit and also need to enter this total on Worksheet 1 - Step 3 line 3a.

A claim for refund for the appropriate quarter to which the additional employee retention credit relates using Form 941-X for the. Use Worksheet 3 to figure the credit for leave taken after March 31 2021. Line 11c Nonrefundable Portion of Employee Retention Credit From Worksheet 1.

Weve put together a spreadsheet to help you with the calculations the program performs behind the scenes. Updated on June 14 2021 - 1030 AM by Admin TaxBandits. The COVID-19 related employee retention credit has been extended and amended.

Qualified sick leave wages. Include the amount of these health plan expenses from the 2nd andor 3rd quarter on line 22 of the 4th quarter Form 941 along with any health expenses for the 4th quarter Enter the same amount on Worksheet 1 Step 3 line 3b. Gather Form 941 information.

Beyond is a browser-based platform which is designed to be easily accessed by utilizing your favorite browser on your favorite device. Enter the same amount on Worksheet 1 Step 3 line 3a. Amounts paid to subcontractors - Cash payments written contracts work orders invoices general ledger check register vendor reports PL disbursement journal etc.

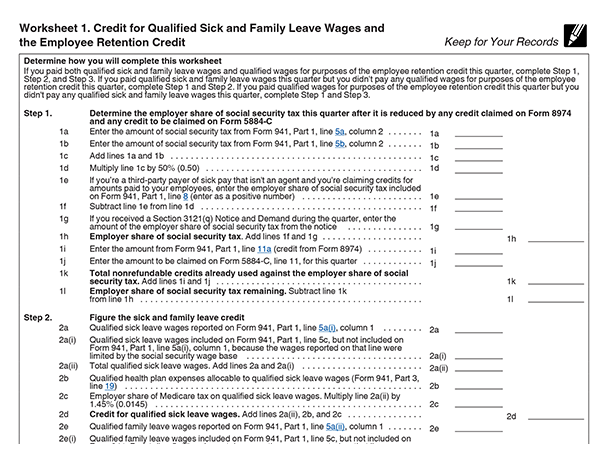

The 941 worksheet and return 941 Return Instructions for Form 941 including the Worksheet for Credit for Sick and Family Leave Wages and the Employee Retention Credit Form 7200 If you have elected to receive a tax credit Paychex will apply the amount of the credits to your federal tax liability each time you process payroll which in most. Determine how you will complete this worksheet. Worksheet 1 is used to calculate the amounts of the credits for qualified sick and family leave wages and the employee retention credit.

Quarterly reports - State unemployment TWC forms or Fed 941. Use Worksheet 1 to figure the credit for leave taken before April 1 2021. All you need to know about Updated Form 941 Worksheet 1 Q2 2021.

Subtract line 3j from line 3f and enter this amount on Form 941 Part 1 line 13d Step 2. For Quarter 2. Enter the qualified health plan expenses for the Employee Retention Credit.

The employer would further use the worksheet to determine the portion of the credit that is nonrefundable and. An employer would use Worksheet 1 to calculate the amount of the employee retention credit for which it is eligible with respect to the reported quarter. Much like with your Form 941 completing Worksheet 1 electronically will help you avoid errors.

This total is also entered on Worksheet 1- Step 3 line 3b. Certificates of insurance - Proof of workers compensation coverage for contractors if applicable. The worksheet for calculating coronavirus-related employment tax credits was updated in the finalized instructions for the 2021 Form 941 Employers Quarterly Federal Tax Return released March 9 by the Internal Revenue Service.

N E W F O R M 9 4 1 2 0 2 0 W O R K S H E E T 1 Zonealarm Results

941 Worksheet 1 Credit For Qualified Sick And Family Leave Wages And The Employee Retention Credit

941 Worksheet 1 Credit For Qualified Sick And Family Leave Wages And The Employee Retention Credit

Https S3 Amazonaws Com Mentoring Redesign Score Ertc Guidance 1 18 2021 Pdf

P R I N T A B L E W O R K S H E E T 1 F O R 9 4 1 Zonealarm Results

Employee Retention Credit Calculation Worksheet

3 11 13 Employment Tax Returns Internal Revenue Service

Form 941 Filing Not Autofilling Social Security In

Https Www Morganlewis Com Media E88fb0dcaadf4a699229f411df239e47 Ashx

Guest Column Employee Retention Tax Credit Cheat Sheet Repairer Driven Newsrepairer Driven News

How To Use Form 941 Worksheet 1 And Why Taxbandits Youtube

3 11 13 Employment Tax Returns Internal Revenue Service

Https Support Skyward Com Deptdocs Corporate Documentation Public 20website Tutorials Software 1178326 Qtrly Fed Taxreturn 941 Report Pdf

941 Worksheet 1 Credit For Qualified Sick And Family Leave Wages And The Employee Retention Credit

P R I N T A B L E W O R K S H E E T 1 F O R 9 4 1 Zonealarm Results

Https S3 Amazonaws Com Mentoring Redesign Score Ertc Guidance 1 18 2021 Pdf

Https Www Morganlewis Com Media E88fb0dcaadf4a699229f411df239e47 Ashx

Https Www Morganlewis Com Media E88fb0dcaadf4a699229f411df239e47 Ashx

0 Komentar Untuk "Form 941 Retention Credit Worksheet 1"

Post a Comment